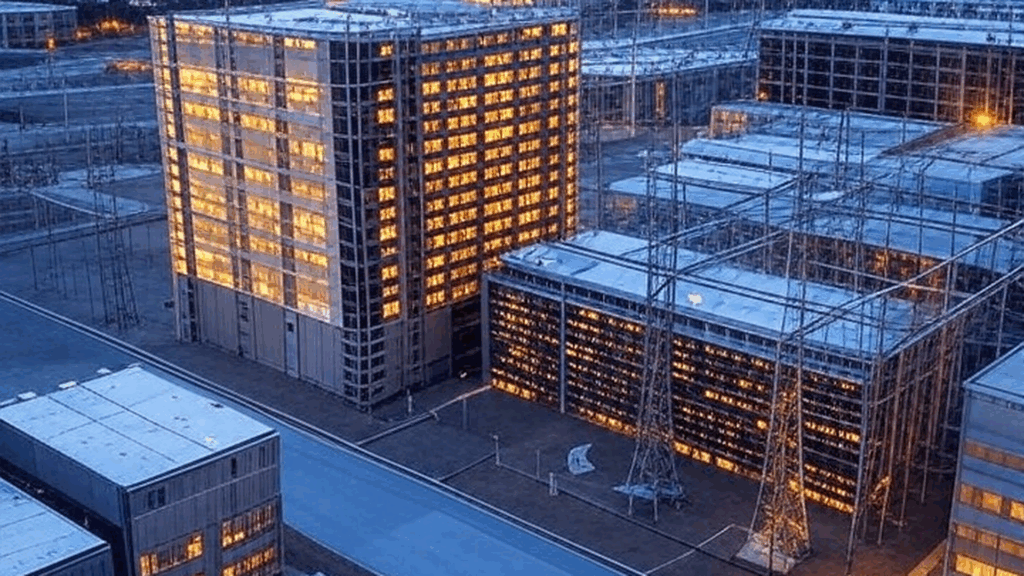

Stargate’s Michigan site shows how AI’s GPU hunger is now reshaping utility capex, with a single 1.4 GW campus adding roughly 25% to DTE’s load and driving billions in new grid and storage investment.

Gigawatt-scale data centers are no longer theoretical, with at least five 1+ GW sites expected online by 2026 and utilities revising load forecasts around ~100 GW of US data center demand through 2035.

Oracle, OpenAI, and SoftBank are pursuing a mix of grid-tied and behind-the-meter gas strategies, but Saline Township is a pure grid play, underscoring that many operators still prefer utility-scale reliability over running their own power plants.

Trump-era policy is explicitly prioritizing AI over regulation and steering projects toward fossil and nuclear baseload, which sets up real friction with state environmental processes and evolving tax incentives.

Utilities are entering a “golden age” on paper, with $1.1 trillion in planned capex and hundreds of gigawatts of new generation, but they are also facing pushback over rate impacts and opaque, fast-tracked deals.

For operators, the Michigan Stargate deal is a template: lock in long-duration power at scale, lean on incumbent utilities for interconnection and resilience, and accept that local politics and permitting will be as critical as GPUs and network design.

The article is worth a full read if you care about how hyperscale AI campuses are colliding with real-world power markets, regulation, and community risk.

Source: What the Michigan Stargate site says about today’s AI market | Latitude Media